DeNovus Capital

A Global Secondary Capital Market Credit Acquisition Firm

DeNovus Capital is a global secondary market credit acquisition firm focused on first position security. We seek to build meaningful relationships while sourcing qualified opportunities in various asset types, along with specialty opportunities in the dynamic global marketplace.

At DeNovus, we believe in making a positive impact in the communities we invest along with the bottom line. It is part of our corporate responsibility to ensure that we are environmentally and socially responsible with each value-oriented transaction. We want to leave the world a better place than it was when we arrived.

Acquisitions may include a loan level basis or portfolio, with an awareness of intrinsic value within each underwriting. Risk averse restructurings, work outs, asset sales, and DIP Financing are also an area for opportunistic stabilization investing.

Credit Acquisitions

- Performing

- Sub-Performing

- Non-Performing (Non-Accruals)

- Hospitality - Franchise & Boutique

- Casinos

- Ski Resorts

- Office

- CRE

- Multi-Family (Market Rate, Work-Force, Senior & Affordable)

- Commercial & Industrial (C&I)

- 1-4 Family

- Large Concentrated Residential

- Mobile Home Parks

- Specialty Purpose

- Self-Storage

Restructuring Opportunities

- Special Situations

- Work Outs

- Restructuring Debt & Recapitalizations

- Debtor in Possession:

- Distressed Financing

- Rescue Financing

- Creditor Advisory Acquisition Opportunities

- Bankruptcy & Post-Reorganization Acquirer

Additional Acquisitions

- Tax Lien Acquisitions

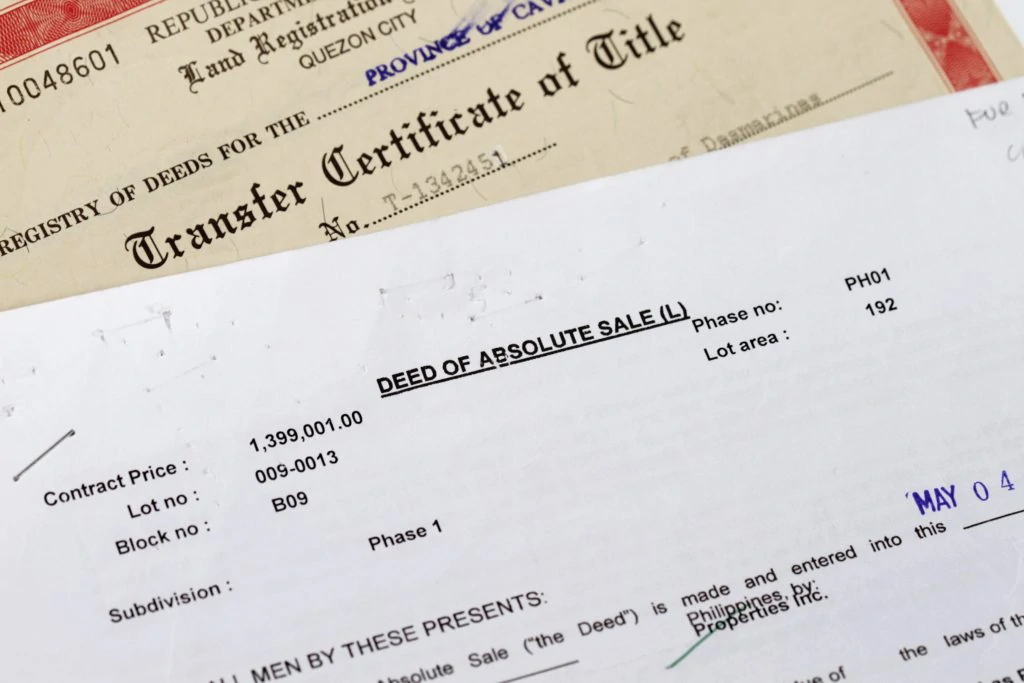

- OREO, REO, Full Accrual, Installment, Reduced-Profit, Cost Recovery, & Deposit Method

- Special Servicer Sales

Clients We Work With

About Our Team

We have experience in real estate renovation construction, new construction, real estate planning, real estate risk management, and loan servicing. Currently, we are looking to extend private loans to clients such as developers, builders, contractors, owners, and operators in need of capital for fast acquisitions, refinancing, and recapitalizations.

ESG Conscious Impact Investing

Why Choose Us

- Closing in 10 Days

- Fair Market Rates

- Flexible Terms Based on LTV of Real Estate Asset

- Real Estate Brokers Are Protected

- Same-Day Loan Decision

How We Work

The role of private money and private capital is becoming more important in the real estate marketplace. Many real estate small businesses rely on private direct money lending more than ever before. This is why the biggest issue for private lending is locating quality transactions on a consistent basis.

At DeNovus Capital, we focus on the collateral value of the underlying real estate, not the credit history of the borrower. We are actively interested in funding your next transaction and would welcome your application for a private money commitment. Compared to most commercial lenders, we do not hold the loans on our clients’ balance sheet. We are a portfolio lender that focuses on quality real estate transactions.

Collateral-based real estate loans are based on the assets’ underlying value. We understand the objectives of borrowers and assist in structuring terms that are fair and fast so you can close your deal and lock in your position. Additionally, we extend and execute confidentiality agreements with all our borrowers to ensure your deal is discrete. We enjoy analyzing and understanding each investor’s real estate opportunity and strive to bring value to you as our client. This is how we form reliable partnerships.

We are actively interested in first position mortgages. Unlike most hard money lenders, we are not an arbitrage lender who sells the loans to hedge funds and financial institutions. We look to hold the loan for a coupon and build relationships directly with the borrower. In our opinion, when the loan is sold to another institution, the quality of the underwriting standards declines and the borrower loses the direct relationship with the lender, thereby eliminating the benefit of a direct lending relationship. Repositioning or improving the real estate asset creates the real value.

We understand that when you’re looking to close a transaction, time is of the essence. You want to lock in your profits and protect your timeline to honor your purchase and sale agreement timeline obligations for performance. We also understand that your price agreement with the seller needs to remain confidential and secure and that your deal should be closed reliably on time.

The coordination among the client, attorney, seller, and lender is an important aspect of every transaction but is often neglected. For this reason, you need a private lender that understands your objectives not just with one acquisition, but the objectives of your overall portfolio. Private money lenders like DeNovus Capital should be a valuable resource for your short-term collateral pledged real estate as a security interest.

Transactions involving commercial loan officers, commercial mortgage brokers, and banks often have differing processes. Transactions with these parties can often move slowly and involve strict procedures for disbursement of your project renovation or new construction funds. Banks and commercial institutions may offer low interest rates, but the interest rate is only one small factor in borrowing money. We understand that seasoned real estate veterans like our clients value their time, and as they say, “time is money.”

Residential and commercial property investors as well as non-owner-occupied borrowers can apply for the following loans:

Commercial Property

First Mortgage

Multifamily

Refinance

Renovation Loan

Are you interested in collateral real estate or a construction loan? We lend private money on first mortgage acquisition and construction loans to investors, builders, developers, and contractors.

The first draw under a construction loan typically will cover closing costs and the purchase price of your lot. We lend seventy percent of the value of projects like this.

If your project includes approved building plans, we would determine a loan value based on the number of units approved post appellate period expiration, the living area, the location, and the current debt on the real estate. Advances under a construction loan are usually not made directly to the borrower. Instead, as a private lender, we typically fund the draws directly to the builder or others that need to be paid to help ensure the project moves along smoothly without third party payment non-payment claims. Converting a multifamily building into condominiums is also a very common practice using private money in addition to a standard hard money purchase of a single-family “fix and flip” project.